refinance closing costs transfer taxes

You didnt reimburse the seller for your share of the real estate taxes from September 1 through December 31. Review Trusted by 45000000.

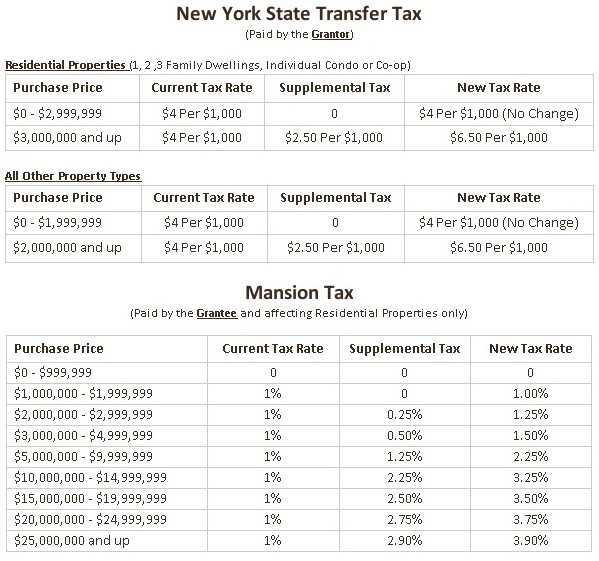

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Refinance Property taxes are due in November.

. Transfer Tax 20 --15 County 5 State First 22000 used to calculate County tax is exempt if property is owner occupied Property Tax 1247 - per hundred assessed value. Ad Compare Your Best Options for Closing Costs in 2021. Unfortunately this can also be costly as many different mortgage fees and closing.

Closing Costs Can Be Complicated We Can Simplify Them For You. You can just subtract closing expenses for a home mortgage re-finance if the expenses are thought about home mortgage interest or realty taxes You closing expenses are not tax. What is the Property Transfer Tax PTT.

If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. You can only deduct closing costs for a mortgage refinance if the costs are considered mortgage interest or real estate taxes. Many states charge a feetax when a home is.

When you buy sell or refinance a home closing costs are a major part of every transaction. In the past borrowers were able to deduct refinance. Does not apply to refis just purchased in PA.

You cant deduct more than 10000 per year 5000 if married filing separately in property taxes sales taxes and state and local income taxescombined. Ad It Costs 0 to Run the Numbers Recalculate Your New PaymentDont Wait Refinance Save. New York 2000.

Taxes account for as much as 60 of closing costs in the Capital Region. Unfortunately you cannot tax deduct your closing costs on your refinance mortgage for your personal residence. Call us for a quote 2675144630 x1.

View recordation taxes collected from borrowers at closing as part of a home loan refinance in DC MD or VA along. For example in Michigan state transfer taxes are levied at a rate of. Review Trusted by 45000000.

To remove and list prior amortization as an expense. Our Home Loan Experts Can Help. North Carolina 1000.

Title policy fees or title insurance. However you can claim this deduction every year until your loan matures. Tax service fees.

Closing Costs Can Be Complicated We Can Simplify Them For You. Typically the only closing costs that are tax deductible are payments toward mortgage interest buying points or property taxes. Our Home Loan Experts Can Help.

This depends on the lender interest rate mortgage loan location of the property and the total loan amount. Your lender does not know what they are doing. Average refinancing closing costs are 5000 according to Freddie Mac.

52 rows Note that transfer tax rates are often described in terms of the amount of tax charged per 500. Other closing costs are not. There is a doc stamp of 350 per thousand and an intangible tax of 250 per thousand required on every refinance in Florida.

Home Refinance Loans Closing Costs. MY DIGITAL BUSINESS CARD. State laws usually describe transfer tax as a set.

Generally transfer taxes are paid when property is transferred between two parties and a deed is recorded. Transfer tax is assessed as a percentage of either the sale price or the fair market value of the property thats changing hands. Go to Your Property Assets page - Along with your rental you should see your original refinancing fees and the.

For example if you spent. All the sellers in the state of Georgia have to pay a transfer tax when transferring the property to someone else. Real estate transfer taxes are considered part of the closing costs in a home sale and are due at the closing.

Miscellaneous abstracts of title surveys recording of deed. State stamp taxes and transfer taxes. If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi.

You must reduce the basis of your home by the 426 122 365 1275 the. In a refinance transaction where property is not. Refinancing closing costs are determined by your lender and the amount borrowed.

It will increase in tax year 2022 to 12950 for single filers and 25900 for married couples filing jointly. Ad Curious How Much You Will Need To Pay In Closing Costs. Ad Curious How Much You Will Need To Pay In Closing Costs.

Ad Compare Your Best Options for Closing Costs in 2021. Which Particular Closing Costs Can You Deduct. A hidden property purchase closing cost here in BC.

It is best to go through the Closing Cost Calculator to get a more. You closing costs are not tax deductible if they are fees. Ad It Costs 0 to Run the Numbers Recalculate Your New PaymentDont Wait Refinance Save.

The same rules apply for closing costs on a rental property refinance.

Ways To Pay Off Your Mortgage Early And Why We Did It

Closing Costs When Paying All Cash For A Home Financial Samurai

What Are Real Estate Transfer Taxes Forbes Advisor

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

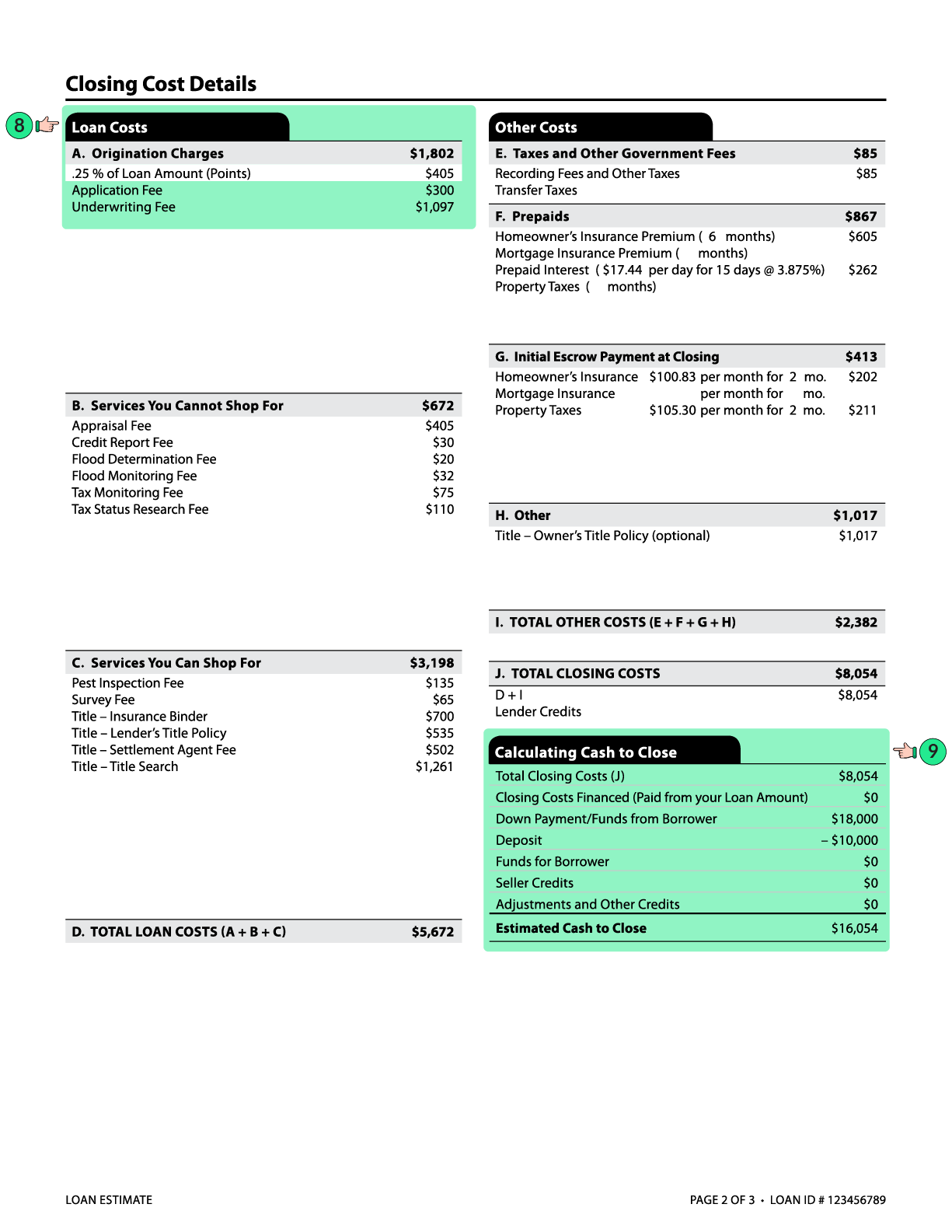

What Is A Loan Estimate How To Read And What To Look For

What Is A Loan Estimate How To Read And What To Look For

Refinance Closing Costs Remain At Less Than 1 Of Loan Amount In 2021 Corelogic S Closingcorp Reports

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Reducing Refinancing Expenses The New York Times

Closing Costs That Are And Aren T Tax Deductible Lendingtree

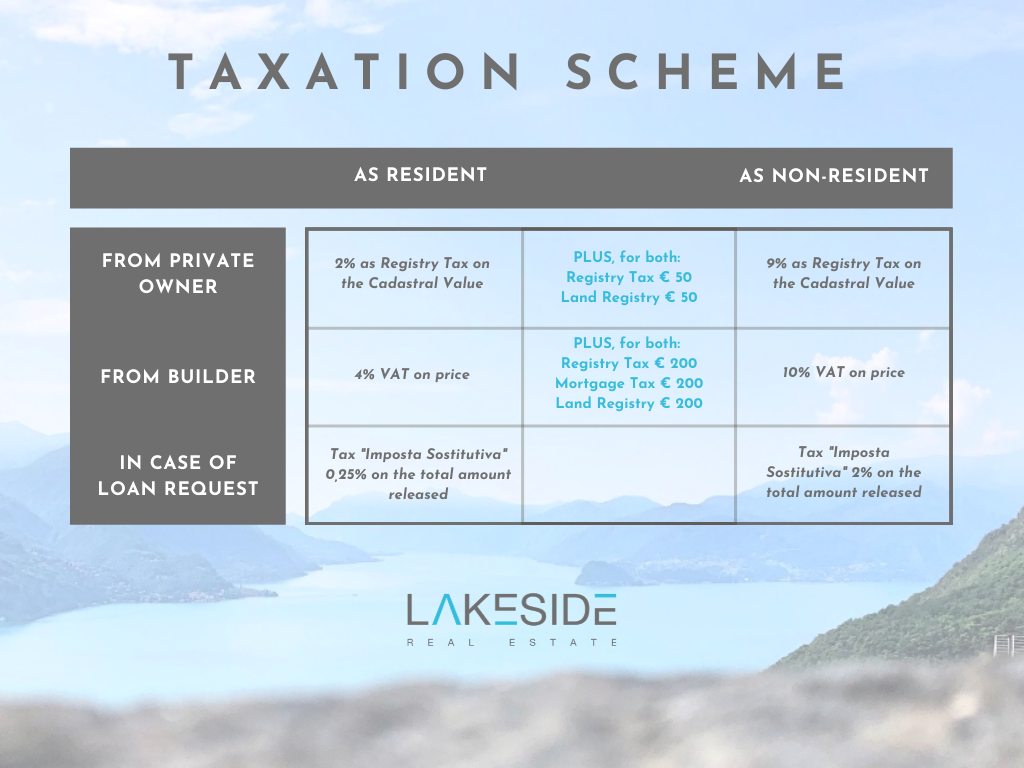

How To Calculate Closing Costs When Buying A Property In Italy Some Practical Examples Lakeside Real Estate

The Complete Guide To Closing Costs In Nyc Hauseit

Texas Real Estate Transfer Taxes An In Depth Guide

Homebuying And Closing Costs Nextadvisor With Time

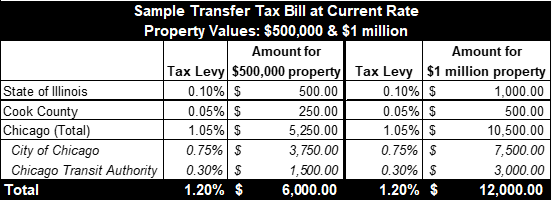

What Is A Real Estate Transfer Tax The Civic Federation

Buyers Don T Be Surprised By Closing Cost Real Estate Fun Real Estate Infographic Real Estate Advice

Real Property Transfer Tax Increase The Judicial Title Insurance Agency Llc